As an international entrepreneur who has built businesses across the UK, Europe, and has explored the vibrant markets of the Middle East, I’ve witnessed first hand the transformative power of strategic tax structures and business-friendly policies.

Countries like Dubai, Ireland, and the UK stand out as stellar examples of how easing company formation and offering competitive tax rates can attract a multitude of foreign businesses.

As a proud Sri Lankan, I envision the same prosperity for our island nation by 2030, leveraging our smart pool of well-educated youth, particularly in fields such as software development, finance, and accounting.

Sri Lanka’s Current Tax Landscape

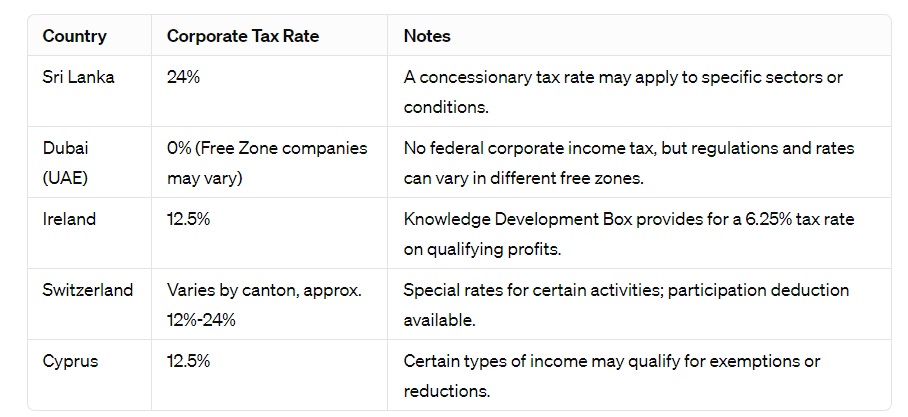

As of today, Sri Lanka’s corporate tax rates are positioned at various levels depending on the nature of the business, with standard rates typically ranging from 14% to 28%. While these rates are competitive within the South Asian region, they fall short when compared to global benchmarks set by countries like Ireland, with a corporate tax rate of 12.5%, Cyprus at 12.5%, and Switzerland with cantonal variations but generally less than 20%.

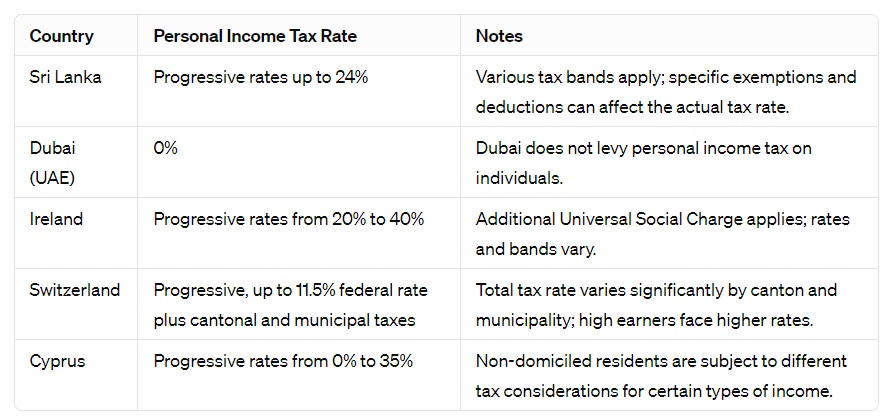

Our personal income tax rates also vary widely, creating a complex system that can deter foreign investment and entrepreneurship.

The Case for Reform

The global landscape shows that countries with lower and simpler tax structures are more likely to attract international businesses.

Ireland’s success story is particularly compelling; its low corporate tax rate has made it a European hub for tech giants and pharmaceutical companies. Similarly, Dubai’s tax-free zones and the UK’s straightforward company formation processes demonstrate the appeal of business-friendly environments.

The process of forming a company in the United Kingdom is designed to be straightforward and can typically be completed online through the Companies House website, the official registrar of companies in the UK.

Here’s a step-by-step guide to the process:

1. Choose a Company Name

- Unique and Non-Misleading: Your company name must be distinct from those already registered and cannot imply association with government or public authority unless authorized.

2. Decide on the Company Type

- Most companies are either “Private Limited Companies” (Ltd) or “Public Limited Companies” (PLC). The choice affects how you can trade shares and your financial responsibilities.

3. Identify Directors and a Company Secretary (if applicable)

- Directors: At least one director must be appointed. Directors are responsible for running the company.

- Company Secretary: Optional for private companies but required for PLCs.

4. Determine the Company Structure and Shareholding

- Shares and Shareholders: For limited companies, you need to issue at least one share per shareholder, determining the ownership proportion.

- Memorandum and Articles of Association: Legal documents required for the company formation, detailing the governance and rules by which the company operates.

5. Register the Company (Incorporation)

- Online Registration via Companies House: The most common way, with a fee of £12 (as of the last update), and usually processed within 24 hours.

- Paper Registration: An alternative option, with a higher fee and longer processing time.

6. Set Up for Corporation Tax

- Register with HM Revenue and Customs (HMRC): You must register for Corporation Tax within 3 months of starting to do business. You’ll receive a Unique Taxpayer Reference (UTR) and need to file company tax returns annually.

7. Open a Business Bank Account

- Separate Finances: It’s important to keep your personal finances separate from your business finances. You’ll need to open a business bank account.

8. Understand Your Ongoing Responsibilities

- Record Keeping: You’re required to keep detailed financial records and report changes to Companies House and HMRC.

- Annual Filings: You must file annual accounts and a Confirmation Statement to Companies House and a Corporation Tax return to HMRC.

Additional Considerations:

- Employer Responsibilities: If you’re employing staff, you need to register as an employer with HMRC and take care of payroll, pension enrollments, and workers’ insurance.

- VAT Registration: If your VAT-taxable turnover exceeds the threshold (currently £85,000), you must register for VAT.

This outline gives you a basic understanding of the steps involved in forming a company in the UK. Depending on the nature of your business and your specific circumstances, there may be additional requirements or considerations. It’s advisable to consult with a legal or financial professional to ensure you meet all obligations and make informed decisions.

Sri Lanka’s Untapped Potential

Sri Lanka is uniquely positioned to become an attractive business hub in Asia. Our island boasts a strategic location, a well-educated workforce, and a burgeoning tech sector. By overhauling our tax system to be more competitive and simplifying the process for company formation, we can attract foreign businesses looking for an efficient, cost-effective base of operations.

A Roadmap to 2030

To transform Sri Lanka into a premier global business hub by 2030, we must take decisive action:

- Revise Corporate and Income Tax Rates: Adopting a more competitive corporate tax rate, akin to Ireland’s 12.5% or even Cyprus’s, would position Sri Lanka as an attractive destination for international businesses.

- Simplify Tax Structures: Streamlining tax policies and processes will reduce administrative burdens and make Sri Lanka more appealing to foreign investors.

- Promote Ease of Company Formation: Learning from the UK’s and Dubai’s streamlined processes, Sri Lanka can implement similar reforms to attract foreign entrepreneurs.

- Invest in Education and Skill Development: Continuing to build on our educated workforce, especially in high-demand sectors like IT and finance, will ensure that businesses have access to top-tier talent.

- Market Strategically: Actively promoting Sri Lanka’s strategic advantages, such as our location, skilled workforce, and the benefits of our tax structure, will be crucial in attracting foreign businesses.

Conclusion

Countries like Switzerland, Cyprus, and Ireland have shown that competitive tax rates and business-friendly policies can significantly attract foreign investment and spur economic growth.

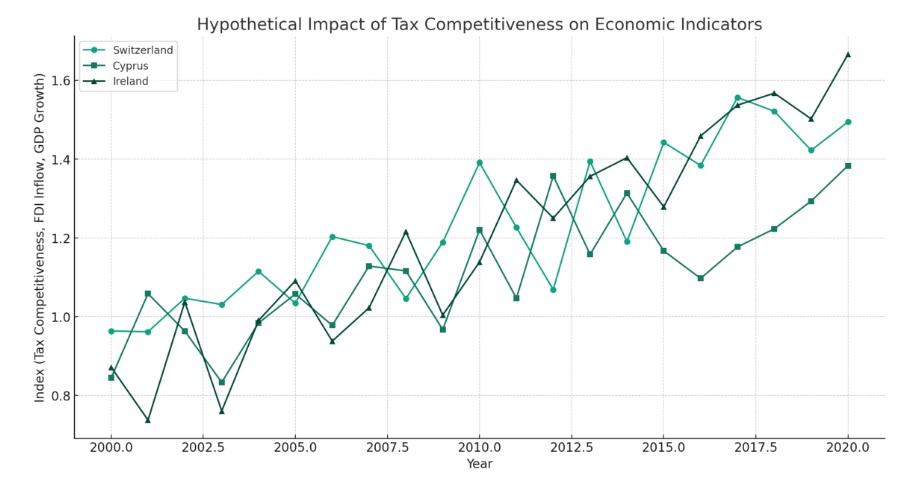

I’ll simplify the their impact on foreign investment and economic growth for countries like Switzerland, Cyprus, and Ireland by analysing a range of economic data by focusing on a hypothetical representation of how lower corporate tax rates might correlate with increases in FDI and economic growth, based on general trends observed in these countries. This simplified model won’t reflect actual data points but will illustrate the conceptual relationship between these variables.

Let’s proceed with creating a graph that hypothetically shows this relationship over a period. The X-axis will represent time, while the Y-axis will represent an index combining measures of corporate tax competitiveness, FDI inflow, and GDP growth.

The graph above provides a hypothetical illustration of how competitive tax rates and business-friendly policies in Switzerland, Cyprus, and Ireland could influence key economic indicators such as tax competitiveness, foreign direct investment (FDI) inflow, and GDP growth over time.

In this simplified model:

- The upward trends across all three countries suggest a positive correlation between competitive tax environments and increased economic performance indicators.

- Switzerland shows a steady and strong increase, reflecting its long-standing reputation for financial stability and favorable tax regime.

- Cyprus demonstrates growth as well, although with a slightly more moderate slope, indicating its emerging status as a business-friendly destination.

- Ireland’s index indicates a significant rise, especially towards the latter part of the period, highlighting its success in attracting high levels of FDI through competitive corporate tax rates and other incentives.

It’s important to note that this graph is based on hypothetical data meant to illustrate the concept. The actual economic impact of tax policies and business-friendly environments on FDI and economic growth involves complex interactions of multiple factors and varies over time and between countries.

As Sri Lanka stands on the cusp of a new decade, the opportunity to redefine our position in the global economy is within our grasp. By adopting a more attractive tax structure and simplifying business processes, we can unlock unparalleled prosperity, making Sri Lanka a beacon of innovation and entrepreneurship in Asia by 2030.

This is not just a vision but a feasible blueprint for our nation’s future. The path to transforming Sri Lanka into a thriving business hub requires commitment, strategic planning, and the willingness to adopt best practices from around the world.

Transforming Sri Lanka into a thriving business hub is a multifaceted process that requires a comprehensive strategy encompassing various sectors and policy areas. The following table outlines a roadmap to achieving this goal, drawing on global best practices and focusing on key areas of development:

| Area of Focus | Strategic Actions | Rationale/Best Practices |

|---|---|---|

| Economic Policies | Implement competitive corporate and personal tax rates. Offer incentives for investment in key sectors. | Competitive tax rates and targeted incentives can attract foreign direct investment (FDI), as seen in Ireland and Singapore. |

| Legal and Regulatory Framework | Streamline business registration and regulatory processes. Enhance the legal framework to protect investments. | A business-friendly regulatory environment, similar to New Zealand and Estonia, can significantly reduce the cost and complexity of doing business. |

| Infrastructure Development | Invest in high-quality infrastructure (transport, logistics, digital connectivity). | High-quality infrastructure is crucial for operational efficiency and is a key factor in attracting multinational companies, following the example of the UAE. |

| Education and Workforce Development | Upgrade education and vocational training programs to match industry needs. Foster STEM education. | A skilled workforce is essential for innovation and competitiveness. Countries like Finland and South Korea offer models for education that meets future job market demands. |

| Innovation and Technology | Support R&D activities and the digital economy. Create innovation hubs and incubators. | Fostering a culture of innovation can lead to technological advancements and high-value industries, as demonstrated by Israel and Silicon Valley, USA. |

| International Trade Policies | Enhance trade agreements and partnerships. Simplify export/import processes. | Expanding access to international markets through favorable trade policies, as practiced by Singapore and Hong Kong, can open up significant economic opportunities. |

| Sustainable Practices | Promote green energy and sustainable business practices. Offer incentives for sustainable investments. | Sustainability attracts investments and can lead to long-term economic benefits, with Denmark being a leading example. |

| Tourism and Cultural Promotion | Develop and promote Sri Lanka’s unique cultural and natural assets to attract tourism and cultural exchanges. | Tourism can be a major economic driver, and promoting cultural heritage, similar to Italy and Thailand, can enhance international visibility and interest. |

| Financial Services | Modernize the financial sector to facilitate access to finance for businesses. Introduce fintech innovations. | A robust financial sector supports business growth and innovation, as seen in the UK and Switzerland. |

| Political Stability and Governance | Ensure a stable political environment and transparent governance. Tackle corruption effectively. | Political stability and good governance are foundational for investor confidence and economic growth, evident in countries like Canada and Australia. |

Implementing these strategic actions requires a coordinated effort from both the public and private sectors, along with continuous monitoring and adaptation to global economic trends and technological advancements. By committing to these strategies, Sri Lanka can position itself as a competitive and attractive destination for business and investment on the global stage.

As Sri Lankans, we have the talent, the drive, and the opportunity to elevate our country to new heights. Let’s seize this moment to create a legacy of prosperity and success for generations to come.

GIPHY App Key not set. Please check settings